Greatest American Bank

Put that coffee down.

In 2004 I was working for a bank in the states, one of the biggest mortgage lenders in the country. Trapped in an office with a corner cubicle, I was surrounded by seven divorcees, some incredible women, and others on the angry and bitter side. They all treated me well, but not so much each other. They sought me out as a sounding board for their petty squabbles. I had to play Switzerland and found the best way was to just listen, nod, and keep my mouth shut. It was a rollercoaster each day.

It was the wild west for home loans.

The underwriting matrix was trashed.

Every application was approved.

You only needed to show up and have a pulse to get approved for anything.

No job? No problem.

No credit? No problem.

“No speakah Ingleesh? No problemo amigo!”

No income, assets, future, brain, or ability to earn anything for all eternity?

No problem. Acme Home Loans had something for everyone.

Between 2000 and 2006 I was a paper server in the trenches of what would bring the entire global financial system to its knees and ruin millions of lives, though I didn’t quite know it at the time. To be clear I did not sell subprime mortgages, only A-paper, but even that became extremely dubious in the years after George W. Bush declared that every American should own a home.

2004 was semi-shady. 2005 was slim-shady. But 2006 was the year things really started to go berserk. All of my initial training was thrown out the window.

One day a low-rent realtor showed up with a Chinese lady client of his. She didn’t speak English. He wore a cheap polyester suit and was looking to Glengarry her into selling her house. Her husband abandoned her and went back to China. She got left with the house and a used Honda accord. She needed money fast. He saw an opportunity: Get her some money through a cashout refi, then get the listing for the sale and make a 3% commission. We arranged for a mandarin translator for the next day and he agreed to pay for it, but then claimed he couldn’t find one and it didn’t matter. She trusted him.

I figured there was no way her application would go through. She checked all the boxes for rejection on the underwriting matrix and while I’d seen the computer approve a few crazy ones, this was by far the looniest. It was Insta-approved. A $320,000 loan with $60,000 of it cashback.

The same thing happened the next month with two deaf, wheelchair-bound lovers who were on disability and wanted to buy a home, but only one of them worked and didn’t earn much.

When you’re a banker you have a lot of undeserved power. People treat you with unearned kindness and respect believing that you are the one thing that stands between them and their dreams. They believe if they act with deference and admiration, it will somehow have an effect on getting the outcome they desire when in reality a computer makes the decision and only the computer can be overruled by a remote underwriting “risk analyst”. But bankers take advantage of this kindness, knowing it makes no difference in the outcome of a loan decision.

A couple of film scenes come to mind here. When Ray Liotta (RIP!) goes to Chase bank in Manhattan to apply for a loan with his son (Leonardo DiCaprio) in Catch Me If You Can. Also in the recent film about Ray Kroc, The Founder, Michael Keaton visits the bank several times for a business loan. You can see the groveling behavior and the self-degrading performances in front of undeserving paper pushers who revel in their power and dominance over ordinary hard-working people.

That’s not to say I took advantage of people, but I did notice how the borrowers behaved toward me and I was never comfortable on the other side of “the sale”.

With this deaf couple, I knew I should have told them no but they were walk-ins, my boss was watching the conference room from his office across the hall and so I filled out the application and told them I’d call them later that day with the news. They shook their heads side-to-side, implying I couldn’t call them. “Come back tomorrow same time,” I wrote on a piece of paper while saying it out loud with over-exaggerated lip motions like an ass.

There was no way it should have been approved, but it was. With back-to-back loans that required a mandarin translator and sign language interpreter at signing, I knew things were seriously messed up.

People wonder how the global plandemic was possible with so many roles played by doctors and lab technicians, nurses and administrators, bureaucrats, and data analysts.

A great con doesn’t need incompetence. It only needs compliant negligence in large numbers.

A great con can survive the minor nodes of rebellion or resistance. If a low-wage lab tech finds their conscience and asks why they’re running PCR cycle thresholds at 35 and asks questions, they can easily be replaced.

A great con doesn’t require consent or an organized conspiracy at all levels, only that people follow instructions and are heavily incentivized to participate. People will all go along with it when they look around and see everyone else going along with it.

They won’t ask too many questions when their salary and livelihood are tied to the very thing they must pretend is real. Especially in the U.S. where healthcare is connected to job security, not just salary and income. The higher up the ladder, the more they’re being paid to go along with it. Throw in years worked toward pensions and it’s game over — everyone will be a great pretender.

I was a great pretender in the mortgage industry for a few years, but quit before it all blew up. On Independence day 2006 I submitted my resignation letter citing the complete absurdity of the business which had lost any and all semblance of fiduciary sanity.

After the twin towers, the Patriot Act, the anthrax deception, the WMD lies, Guantanamo Bay, the Abu Ghraib torture, and the mortgage scam, I realized most of life in the U.S. was consensual participation in great cons and even greater crimes.

Every industry was simply corporate socialism, looting the treasury. Nothing has changed. And everything today is much worse.

I put my condo up for sale a few months later and planned a whole new life in a whole different part of the world and never went back.

When they bailed out the banks responsible for the mess with a few trillion dollars and nobody went to jail, and there were no riots, and the Federal Reserve building still stood and all the bank CEOs showed up to the White House to have a beer with Obama who did some mild finger waving, I knew without a shred of doubt that we were, and still are watching a late stage failing empire.

The whole mortgage experience did produce a screenplay and a one-act stage play called Option ARM, named after the insane mortgage product that allowed borrowers to choose what payment option they wanted to make each month including one with negative amortization.

It may read like a farce, but it’s based on true events and real people, including one who served six years in prison for mortgage fraud.

The short play appears as text below. If you prefer to read it as a PDF you can download this file.

Option Arm 136KB ∙ PDF File | ||

| ||

Option ARM

Setting: Mortgage division inside a branch of Greatest American Bank in any town, U.S.A. Sometime between 2005-2007.

Cast of Characters

JAMESON HENRY (20-30) New guy. Eager to learn.

YORGI IPANEMA (50’s) Office manager of Turkish/Brazilian descent and self-proclaimed guru. Stout. Comb-over. A fast talker and loud. Broken English.

GEOFF (30-35) Top seller in the region. Designer suits. Wears a permanent Bluetooth phone headset around his $200 haircut.

DAGNY (40-45) Skinny insecure divorcee. Nervous jitters, yet still a top seller.

BIRDY (35-40) Another divorcee. Dagny’s devout echo and shadow.

MICK (50) Local realtor in a cheap suit. Greasier than Astroglide.

LIEN HAU (40) Chinese lady seeking a loan.

MASSEY (50s) Regional VP at corporate headquarters. Voice only Off Stage.

Scene Breakdown

Scene One ..............................

Scene Two ..............................

Scene Three ..............................

Scene Four ..............................

Scene Five ..............................

Scene Six ..............................

Scene Seven ..............................

SCENE ONE

YORGI heads up the conference, his sleeves rolled up and all down to business. Loan officers GEOFF, DAGNY, and BIRDY sit around an oval table. The ladies scribble on notepads. Geoff is bored. In the center of the table a fancy speaker phone connected to the main office and Regional VP MASSEY.

(JAMESON STROLLS IN LATE)

YORGI

You still there Massey? Chief we all here now. The new kid was late. Why were you late?

JAMESON

I was on the phone with a client.

MASSEY (O.S.)

Did you make a sale?

YORGI

Did you make a sale?

JAMESON

I don’t know.

YORGI

What do you mean you don’t know?

MASSEY (O.S.)

What do you mean you don’t know?

JAMESON

Do we loan on yurts?

YORGI

What the hell is a yurt?

GEOFF

It’s like a cabin. Sure we do. I’ve done plenty of them. That’s not my client you’re closing is it?

MASSEY (O.S.)

It’s a tepee or a hut. Good work kid, we can sell that note as B paper to Niles Jorgensen.

YORGI

Good work kid. Call them back after the meeting.

JAMESON

Thanks.

MASSEY (O.S.)

Open this thing up Yorgi, I gotta a three-thirty tee time.

YORGI

Right, let’s get down to brass tacks. It’s contest time again and the stakes are high. New product development division has rolled out a premium new option product.

DAGNY

We got an option product? Finally. It’d better be something I can sell. Fixed or ARM?

BIRDY

It’d better be something good.

YORGI

It’s an ARM.

(SUBTLE EXCITEMENT)

MASSEY (O.S.)

That’s right, we’re unleashing a product that no other financial institution could even conceive of. R&D spent over a year and the bank has pumped millions into this concept. It’s called Option ARM! Yes, the Option ARM. It has, are you ready for this folks? Seven, I’ll say it again, seven options for the borrower to choose from each month!

DAGNY

Each month? Wow.

(GEOFF’S LIGHT BLINKS ON HIS EARPHONE DEVICE)

GEOFF

Walsh here.

MASSEY (O.S.)

Yeah, what is it Walsh?

GEOFF

I’m in a meeting.

MASSEY (O.S.)

Yeah, I hope you’re in this meeting Walsh, Yorgi tells me you’ve missed the last ten.

(YORGI PUSHES A BUTTON ON THE PHONE TO MUTE THE MIC)

GEOFF

Can it Massey I’m on the phone - no they aren’t being honest with you, of course I can do better than that, I can do anything Mr. Wilkins. Drop by my office in the morning. Okay, that’s good.

YORGI

You done now? Jesus Geoff, you can’t talk to Massey like that god damn you.

GEOFF

Fuck Massey. He’s never sold shit.

YORGI

Fuck Massey? No fuck you!

MASSEY (O.S.)

You still there, hello?

(YORGI UN-MUTES THE SPEAKER PHONE)

YORGI

Sorry boss. We all here. Go on.

MASSEY (O.S.)

Well, that’s all I suppose. Seven choices. Yorgi finish me off, my car is waiting

downstairs. Good luck with the contest. If you can’t sell this product, you can’t sell shit, you might as well park it at a credit union for the rest of your careers.

YORGI

Okay. Thanks Massey, I’ll take it from -

(LOUD CLICK SOUND OF MASSEY HANGING UP. YORGI HANDS OUT PAPERS.)

YORGI

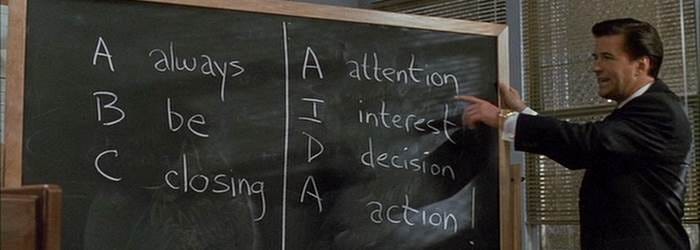

You heard it ladies and ladies seven big ones to offer each month. As you can see a start rate of 0% for first month. No interest for first month, there’s your hook. Bam! Go with that from the start. Option number one thirty-year amortization based on the LIBOR index. Option two is a twenty-year amortization based on the Rowe Index. Option three is a fifteen year on the LIBOR. Option four 7/1 pricing on the MTA index. Option five is the max minimum payment a fixed payment based on the MTA index and it is interest only. Tell the borrower interest only. Low payment will help them be cash rich since they are already house-rich. Big selling point. Use the value of their property and these ultra-low payments. Put on paper and show them the thousands upon thousands they will save each year compared to conservative fixed products. Promise them extravagant holidays, kids college education, second or third cars, they can have more money in pocket to finally live American Dream.

(GEOFF GETS UP TO LEAVE)

YORGI

Where are in fuck YOU go?

GEOFF

I’ve got it. You don’t need to tell me how to sell Yorg. Is this the prize, Aruban holiday all paid? Might as well book it in my name Yorg, I’ll email my hotel and air preferences. Good luck all.

(GEOFF EXITS WHILE ANSWERING HIS PHONE REALLY LOUD)

GEOFF

Yuuup Walsh here!

YORGI

Asshole! I’m sorry. But he is big fucking asshole. I want you to shadow me, not him Jameson.

JAMESON

But Massey told...

YORGI

I don’t care. I sold three hundred million in my career. I am the boss. You shadow the best to become like the best.

JAMESON

Okay. Fine. Sure.

DAGNY

What is option six here, the “penultimate minimum” payment?

YORGI

Yes, penultimate minimum is lower than the maximum minimum. Negative amortization do not tell them. If I hear the words negative and amortization used in same sentence in this office, you will be fired.

JAMESON

What is negative amortization?

YORGI

Jesus. Geoff don’t teach you? Okay, it’s best you don’t know but if borrower ask, just say yes on the last three options and pretend you know what it is okay?

DAGNY

Oh Yorgi, be fair to the kid. It’s when the borrowers aren’t paying all the interest to the bank and the interest gets added on to their loan, so instead of paying their loan down, it actually increases each month.

YORGI

Yes good. Now final payment is lowest of any bank in world, guaranteed. Make this guarantee to borrowers. It is called “Borrower’s Choice” and is zero percent interest. Yes, zero percent interest.

DAGNY

I thought the whole product was a borrower’s choice, that’s why it’s an option product.

YORGI

Yes, but within the borrower options here, the final option is a borrower’s choice.

BIRDY

A borrower’s option within the borrower’s choice?

YORGI

No no. You not listen. Borrower’s choice is one option of option ARM product. Okay okay? We got it now? And is zero percent.

DAGNY

If it’s zero percent, then what’s their payment?

YORGI

Whatever they want it to be, is borrower’s choice.

DAGNY

How do we calculate that?

YORGI

Not for you to calculate. Borrower chooses any amount they want to pay.

BIRDY

So like $100?

YORGI

Yes. Any number, is borrower’s choice.

BIRDY

So like $10?

YORGI

Yes. Ten dollars. One dollar, any number, any whole number, any prime number, any prime number divided by pi, is borrower’s choice.

JAMESON

I don’t get it. What’s the catch?

YORGI

I don’t know yet. It’s in the fine print there, but it can’t be good.

DAGNY

It says here…uhh…Penalty fee of $500, plus two point two five percent of remaining loan balance added to the outstanding balance including all interest accrued.

YORGI

Yes, whatever it say there. Again, do not tell borrower. If I hear the word penalty in this office you will be fired. Fine print is there for them to read, if they cannot read, is not our problem. Get signatures on papers first, when loan funds and they read fine print at home, if they want to change product we do another loan and so on. Seller of most Option ARMs will go to Aruba in May. Got it? Good. Now go sell.

(YORGI EXITS THE CONFERENCE ROOM)

SCENE TWO

JAMESON’s office with drab prefab office decor, desk and computer. His phone rings.

JAMESON

Thanks for calling Greatest American Bank, this is Jameson. Ah, yes thanks for calling me back Mr. Peterson. Okay Mick. The reason I called - what’s that? Oh, great. I’m pretty - yes sure I can help, is this a sale? A Refinance? But aren’t you a realtor with Rector Properties? So it’s your own property? Chinese? No, I don’t speak it.

(GEOFF ENTERS SWINGING A GOLF PUTTER, SLEEVES UP.)

JAMESON

Yes, well let me check my calendar first, one moment.

(HE LOOKS AT HIS COMPLETELY WHITE CALENDAR)

JAMESON

Uh, Thursday, Thursday, how’s eleven o’clock work? Great, and you’ll be coming together with? Lean? Can you spell that? L-I-E-N. Lien - got it. Okay Mr. Peterson, uh Mick, we’ll see you then. Bye now.

(HANGS UP THE PHONE AND PRETENDS NOT TO BE IMPRESSED WITH HIMSELF)

JAMESON

Another realtor wants to meet.

GEOFF

See, I told you if you cold call the bottom feeders first, chances are they won’t be working with me and you’re free to solicit their business. I won’t hold those others against you, but if you see a Multi-million dollar club symbol, come check with me to see if I already work with them before you introduce yourself. Who was that?

JAMESON

Uh, Mick...

GEOFF

Peterson. Oh lord. He’s a good man though. Straight shooter. Probably hasn’t sold a house this millennium but at least you’ve got one under the belt.

JAMESON

He’s actually bringing in a borrower for me.

GEOFF

So he’s got a deal going eh?

JAMESON

She’s a friend of his family. A Chinese lady who doesn’t speak English.

(GEOFF MOCK PUTTS ON THE CARPET)

GEOFF

Don’t waste your time with a pre-qualification, those things end up wearing down your numbers for months. Yorgi likes them, but he’s clueless. Wait til they sign a buyers agreement and set a closing date, then hook em’.

JAMESON

Okay, thanks. But It’s actually a refinance, the Chinese lady already owns a home.

GEOFF

Doesn’t speak English? That’s a grand slam kid. Go for an Option ARM, easy sell. Add two points on the back end for yourself. (PHONE DEVICE BLINKS) Walsh here.

(YORGI ENTERS as GEOFF EXITS on the phone)

YORGI

What is he doing here? Motherfucker. I tell him you shadow me, not him. How are things? No applications from you all week, why not?

JAMESON

I’ve got one. A refinance, it’s not on the system yet, but I’ll get it up there.

YORGI

How much?

JAMESON

Jumbo. Jumbo for sure, with two points on the back end. A realtor referral. Million dollar producer for Ganton Group. Chinese business tycoon.

YORGI

Look at you. Good work kid. Sell the option ARM jumbo, remember to show money in pocket. More money for tycoon to invest and make more money. This things sell themselves. You want lunch? Come, I buy you lunch and teach you all the Yorgi Ipanema selling tricks.

JAMESON

Yeah, sure.

(JAMESON GRABS HIS COAT. YORGI PUTS HIS ARM AROUND HIM.)

YORGI

How is your Yurt deal coming along?

SCENE THREE

Inside Dagny’s office. White leather decor with bright generic cubist rip-off art. DAGNY is at her desk speaking loudly. BIRDY sits admiring her mentor.

JAMESON appears in the doorway with paperwork in hand.

BIRDY

Shhhh. She’s finishing off a big one.

DAGNY

Well it’s been all my pleasure Garrett. I know. I know, it’s one of the silliest deals. Oh, I suppose I knew we could do it, it’s just better - I have a policy of being honest from the outset. It’s just not good business to make big promises. Oh, that’s so sweet of you, thanks. I will, and my best to Martha. Okay. Okay. Okay. Will do. Bye bye.

BIRDY

You did it?

DAGNY

It’s funded. One and a quarter.

BIRDY

Amazing.

JAMESON

Congratulations, that’s great.

DAGNY

I knew it Birdy. I knew it when I first sat down with them. Where does that put me with Geoff?

BIRDY

Within two hundred thousand.

DAGNY

I’m gonna catch him doggonit. This year is mine Birdy.

BIRDY

Oh, I know it is. I know it.

JAMESON

Congratulations. Can you help me with something?

DAGNY

Sure hone, what is it?

JAMESON

I’m doing an Option ARM on that Yurt property.

DAGNY

Yes, the tepee. Uh huh.

JAMESON

The client wants to know about the borrower’s choice option.

DAGNY

Option seven. Uh huh.

JAMESON

They think it can’t be possible, that they could just pay any amount they want each month.

DAGNY

Oh honey, just tell them we are connected to the largest investment firms in the country and we have the freedom to set the terms on our products because we’re the Greatest American Bank. It works every time. When in doubt just confuse the borrower. Talk real fast like I am now and they’ll be funding their loan before you know it.

BIRDY

Yup. I learned that from her. Confusion works.

JAMESON

Confusion and talking fast. Okay, I’ll try that, thanks.

DAGNY

Oh and honey, don’t listen to what Geoff tells you. He’s a cheat. He’ll cheat his way to any deal. He’d sell his mother on the street to make a buck, okay? You need to play honest here and you’ll do really well for yourself.

JAMESON

Yeah, sure. Okay. Oh, I almost forgot, do either of you speak Chinese?

BIRDY

Mandarin or Cantonese?

(LIGHTS GO DARK)

SCENE FOUR

Inside the Conference room, JAMESON sits with the Chinese borrower LIEN as the realtor MICK paces around the room feigning interest in the cheap pastel wall prints.

JAMESON

Then how much is your home worth would you estimate?

LIEN

Home, yes. Money home.

MICK

Look Jason, it hasn’t been appraised recently, but I would put it around the 350 mark. Yeah, it’s safe to say 350. We use my appraiser, he’s a good guy, he’ll bring it in for us at whatever we need.

JAMESON

Uh, sure. Okay.

MICK

Great, just put 350 then.

(JAMESON FILLS OUT THE LOAN APPLICATION)

JAMESON

What is your last name Lien? LAST NAME?

LIEN

Name Lien.

MICK

It’s Hau. H-A-U.

JAMESON

Lien Hau. Lien Hau. Okay great. Do you know the property address?

MICK

I’ll email you that later, look is this gonna take long or?

JAMESON

I just need some employment, income, and asset information. (to Lien) WHERE DO YOU WORK LIEN?

LIEN

Work. No work.

JAMESON

You don’t have a job? JOB?!

MICK

Her husband left her last summer. Went back to China, he was the bread winner. She’s never worked. Chink culture thing kid. How much longer we got here?

JAMESON

Okay. No job. What about, well that means no income - any income? Gifts, social security, welfare?

MICK

Probably not. I don’t think she would qualify for any of that.

JAMESON

Right. Okay. How about assets, cars, jewelry, Rembrandt paintings? CAR, LIEN?

MICK

No, she owns her car outright. I know that. It’s one of those jap-mobiles. Honda or Hyndai or something. No Lien. Did I mention she wants cashback?

JAMESON

This is a cash-out refinance?

MICK

Yeah, she needs about forty thousand after closing costs. I know you’ll probably dump a few points on the back end for yourself, so just make sure you calculate forty K after all that.

JAMESON

What’s the money for?

MICK

I’m gonna help her sell the property, you know since she can’t really make payments. She’s agreed to a retainer for my services. All the rest will be used for her to live until we can sell the house.

LIEN

Mick sell house. Mick do sale. Mick do house sale.

MICK

Uh huh. HE KNOWS THAT LIEN. Damn, I taught her that line too well.

JAMESON

Okay. So a Honda, I’ll just put here it’s an Accord LX newer model, plus Jewelry, and other assets at twenty-five thousand.

MICK

That’s probably about right.

JAMESON

Sign here Lien.

LIEN

Yes. Me Lien.

MICK

Signature. SIGN with pen. Put the pen in her God damn hand so she knows.

(JAMISON DOES. THEN PUTS HIS FINGER ON THE LINE. SHE SIGNS.)

JAMESON

She signed in Chinese I think.

(MICK PEERS OVER THE TABLE. GRABS THE PEN AND FORGES HER SIGNATURE)

MICK

Does that look lady-like? I think that’ll do. Thanks for your help Jonesy. When can we expect to get her in to sign documents?

JAMESON

Soon. I’ll get this on the system right away and we’ll get things rolling for you, uh for her and then I’ll be in touch. You’ll be signing at an escrow company.

MICK

Okay great, let me give you the card of my brother. He’s an escrow officer and he’ll be handling the signing then. Here you go.

JAMESON

Uh Mick. I think maybe we should have these documents translated to Chinese, or whatever she speaks.

MICK

Is that a requirement for Great American Bank?

JAMESON

Uh, no. I don’t think so. I’m not sure though, it might be.

MICK

Look. Just run the numbers. Do whatever you have to do and I’ll be sure to pass your name around the office. A lot of realtors looking for a go-to lender out there if you know what I mean.

JAMESON

Right. That sounds great. We’ll get this done for you no problem.

MICK

Good. Come Lien. WE GO.

SCENE FIVE

Inside YORGI’S office. YORGI watches porn on his computer, the sounds of nasty sex ring out. A half-eaten box of donuts on his desk and one stuck in his mouth. Knock at the door. He fumbles with the mouse, the donut drops to the floor, he struggles to close the browser window.

YORGI

Come in.

(JAMESON PEEKS IN)

JAMESON

I’m not interrupting.

YORGI

No, don’t be crazy. Here sit down, have a donut.

JAMESON

No thanks. I wanted to run this deal by you. The one with the Chinese lady.

YORGI

The Chinese tycoon, yes of course. How much was it?

JAMESON

Well, it’s just barely a jumbo. It’s 390,000 with forty thousand cash back.

YORGI

Not bad. What’s problem?

JAMESON

Well, um, she, the borrower doesn’t have a job.

YORGI

Go low documentation.

JAMESON

Low doc? Right, I’m going to, of course, it’s the only way.

YORGI

So what is problem?

JAMESON

Well, she doesn’t have savings either?

YORGI

She? I thought it was tycoon?

JAMESON

Uhh, no tycoon’s ex-wife.

YORGI

Then go no documentation.

JAMESON

No doc? There’s such a thing?

YORGI

Of course. Borrower no have to show or prove anything. Very high rate, but if she need money, which sounds like she do, then go no doc. I thought this was some business tycoon? How she have no money?

JAMESON

The realtor said her husband is, but he left her.

YORGI

Oh, too bad for her. So we have no problem then?

JAMESON

Well, she also doesn’t speak English.

YORGI

Did she sign her name on loan application already?

JAMESON

Yes.

YORGI

Then we have no problem. Make sure you add maximum points for you and bank on the back end. Should be four percentage points.

(HE LIFTS A CHART TO CONFIRM THE NUMBERS.)

JAMESON

I will, yes of course. So that means four percent of the 390,000, which is sixteen thousand dollars split between myself and bank.

YORGI

Yes. Good job for you. I buy us lunch again when loan funds. Anything else?

JAMESON

No. No. I just wanted to confirm this low doc, but now I’ll make the switch to no documentation and get this thing rolling. Rolling down the river. Fast.

YORGI

Good. Close my door.

(LIGHTS GO OUT. SOUNDS OF PORN ON YORGI’S COMPUTER)

SCENE SIX

In JAMESON’S office going over the final terms of the loan for LIEN with MICK present also. Jamison scans the long documents he places in front of her. She doesn’t understand anything.

JAMESON

At eight and a half percent the first month because we had to go with no documentation. You understand Lien? NO JOB. NO MONEY. BIG RATE. HERE. EIGHT POINT FIVE.

LIEN

Yah. Eight punt fiv. Yah. Yah. Okay.

JAMESON

After the first month, it will GO UP. SEE, GOES UP TO THIRTEEN PERCENT.

MICK

Damn that’s a shitty rate.

JAMESON

Yeah, well it was approved.

(GEOFF STRUTS IN)

GEOFF

What’s all the yelling over here - oh you working with the chink. How are you Mick? Sell a house yet?

MICK

Fuck you Walsh. I’m gonna make sure everyone at the office switches over to Jimbo here. He’s a hell of a loan officer.

JAMESON

Oh, you don’t need to do that.

GEOFF

My guys are loyal. Try what you want if it pleases you. You tack on the maximum points to the Chink’s loan?

MICK

Get your ass out here before I kick it out.

GEOFF

Ha. Right. Pathetic. Keep it down newbie.

(HE SLAMS THE DOOR.)

MICK

Cocksucker has fucked over every realtor in town at least once. You play your cards right Jim, you’ll be taking all his business.

JAMESON

Right, well, back to the terms.

MICK

Oh, I don’t think this matters much since she don’t understand nothing. Does she need to sign anything here?

JAMESON

No. That’s all I guess, then. I’ll make sure your brother gets the documents for signing tomorrow.

MICK

Great. Nice work Jim. Come Lien. WE GO.

LIEN

Money!? Where money!? Give me money!

MICK

Not here you goofy broad. NOT HERE. TOMORROW.

JAMESON

Wait. Here take some of my business cards, you know to hand around the office.

MICK

Right. Thanks.

SCENE SEVEN

YORGI heads up another meeting in the conference room. ALL loan officers are there and MASSEY is again on speaker phone.

YORGI

Okay, we all here boss.

MASSEY (O.S.)

Walsh, is he there?

(GEOFF GIVES HIM THE FINGER)

YORGI

Yes. Yes.

MASSEY (O.S.)

Good. First off congratulations to all of you. Some impressive numbers on this year’s contest, but like the past five years Geoff won by a landslide.

DAGNY

Cheater.

MASSEY (O.S.)

Well done Geoff, you were headed to Aruba for a week in the sun, but the company has since decided to cancel all awards.

GEOFF

What the fuck? That’s bullshit!

MASSEY (O.S.)

Hold your horses Geoff. You get a better prize. You’ll be taking over my job as regional vice president of sales. There’s going to be a slight shuffle within the company.

DAGNY

Oh my God. What is happening?

MASSEY (O.S.)

Calm down Dagny. There’s been a merger. More of a takeover by High Crest Financial. They’re keeping their mortgage business and dismantling Greatest American Bank’s mortgage division since they are better producers than us.

YORGI

What is the fuck is happening Massey? You never tell me nothing about this?

MASSEY (O.S.)

You’re gone Yorgi. Pack it up. All the rest of you are too. Sorry folks. They’re sending someone down there now to repo your computers and shut down the office. Please have your -

(YORGI PICKS UP THE SPEAKER PHONE AND THROWS IT AGAINST A WALL)

YORGI

You mother of mother of fucking pigs!!! I fucking piss on you.

BIRDY

I can’t believe it.

DAGNY

How could this happen during our best sales year ever? Bank of America offered me a job last week and I turned it down. Oh God. How God, how could this - my contacts! On my computer!

(YORGI AND JAMESON ALONE IN THE CONFERENCE ROOM)

JAMESON

Yorgi?

YORGI

What?

JAMESON

Do I still get paid for the Jumbo refi? The Chinese lady?

(YORGI LEAVES THE ROOM HALF CRYING. CURSING TO HIMSELF. LIGHTS GO DARK)

No comments:

Post a Comment